At the beginning of the SteelOrbis Fall 2024 Conference & 91st IREPAS meeting held in Paris on September 15-17, Luciano Giua, economist and policy analyst at the Organization for Economic and Cooperation and Development (OECD), explained why steel is so important in the worldwide economic scenario.

Since it is a widely used material in the metal industry and in construction, not to mention national defense and security, it is fundamental in the employment of a very high number of people. Mr. Giua noted, adding that that is why governments care so much about steel and why it is so susceptible to protectionism. On the negative side, he said, steel markets are inefficient and subject to overproduction and they have a very strong impact on emissions.

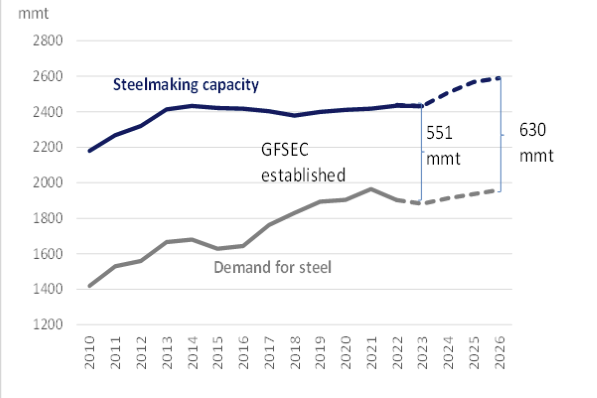

The OECD has three committees dedicated to addressing global market steel issues: the Global Forum on Steel Excess Capacity (GFSEC), the OECD Steel Committee, and the Climate Club. The gap between global steelmaking capacity and global steel demand is growing rapidly, Mr. Giua pointed out, stating that the gap amounted to 551 million mt in 2023 and that the forecast for 2024-26 is about 630 million mt.

Steel demand in Europe, he said, decreased last year, originating from the Russian-Ukrainian conflict, higher energy costs and trade issues, while on a worldwide level the decrease was 1.1 percent in 2023, but the forecast is that the steel demand will grow by 1.7 percent in 2024 and by 1.2 percent in 2025.

This growth prediction, the OECD official said, is based on the gradual recovery of the steel market from the previous crisis, but some issues still persist, which is why steel firms are experiencing low profitability. In 2023, he indicated, the average profitability of the global steelmaking industry saw a 77 percent decline, with excess capacity being one of the main reasons behind this.

The main party responsible for this phenomenon, Mr. Guia noted, is China as the country's steelmakers are receiving a lot of government subsidies, especially during periods of profit decline, while Chinese state-owned enterprises (SOEs) in particular receive more subsidies per asset compared to Chinese private enterprises (POEs).

The question is, Guia said, are we facing a new global steel crisis? Compared to 2014/2015, the global context is changing, he stated, with excess capacity happening in an uncertain economic and geopolitical scenario, where BOF-based capacities are growing faster than EAF-based capacities. He concluded by saying that the GFSEC is trying to implement some strategies to reduce excess capacity, as this would lead to higher steel prices, more resources for steel companies to innovate, a lower waste of critical raw materials and greater stability in the steel markets.

Read more: IREPAS chairman: Global long steel market becoming more and more unstable

Vietnam Steel by Hoa Sen Group