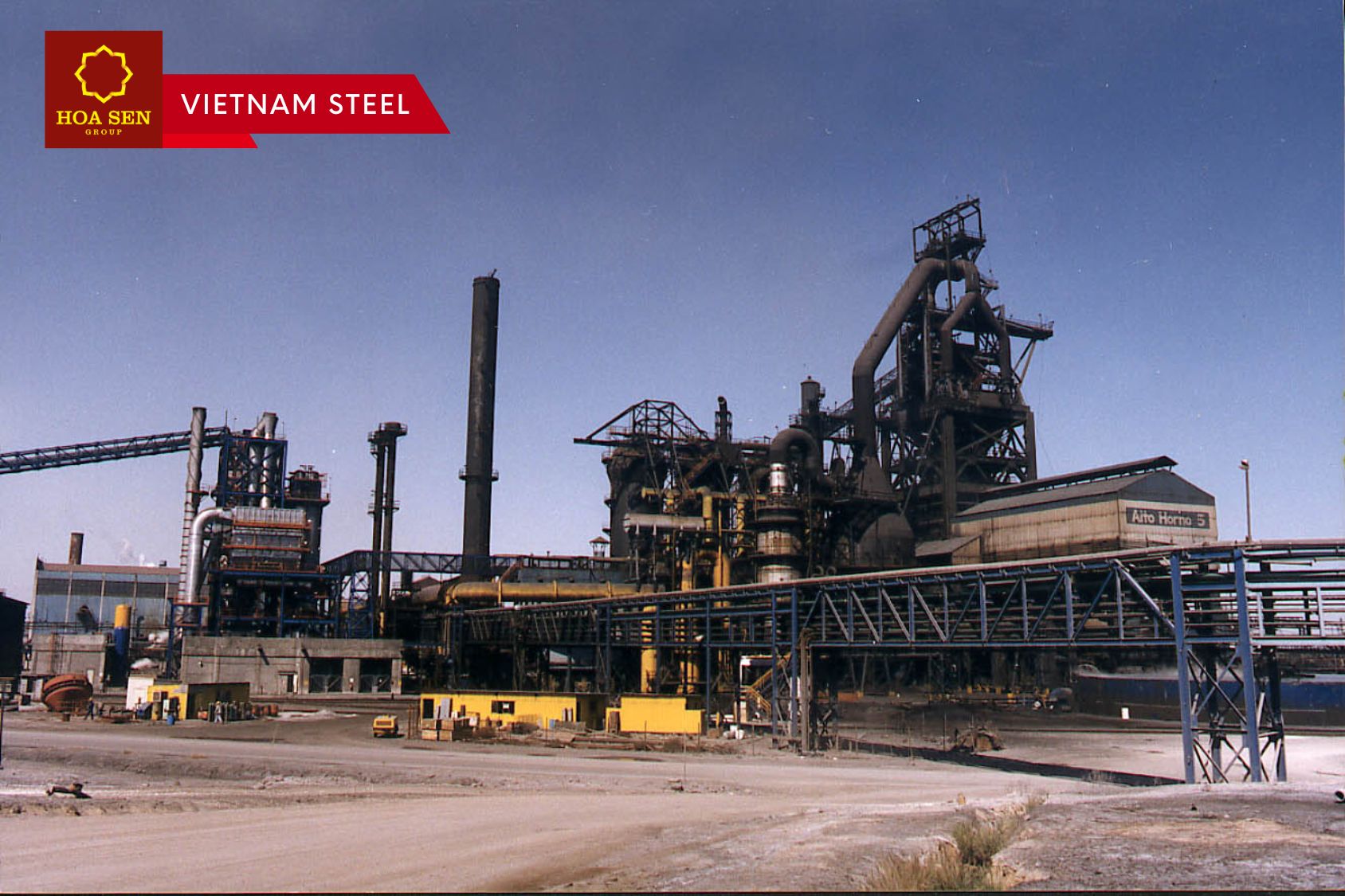

The Mexican steel giant Altos Hornos de México (AHMSA) acknowledged that in the coming days it will be declared bankrupt after failing to reach an agreement with its creditors in the bankruptcy process that began in May 2023. With that declaration, the company may be sold free of liabilities and zero pesos for its main shareholder Alonso Ancira Elizondo.

"After concluding the last extension of the conciliation stage in its Commercial Bankruptcy process, AHMSA will enter the bankruptcy phase, whose declaration will be issued at any time by the head of the Second District Court, Ruth Haggi Huerta," the company reported on their social networks.

At that stage, an auxiliary body of the judicial system (Ifecom) will assume control of the AHMSA company. With the bankruptcy, the Receiver will seek the sale of the company, for which the shareholders led by Alonso Ancira will not receive monetary resources from the sale of the company. The money raised from the sale will be used to pay creditors.

According to AHMSA's most recent public information, as of December 31, 2022, AHMA's total liabilities were $2.93 billion and its assets were $2.11 billion. With bankruptcy, the sale will be free of liabilities.

Although the sale of AHMSA and its unit Minera del Norte (Minosa), also already in bankruptcy, will be carried out by the Receiver, AHMSA commented that its financial advisor, the French Rothschild & Co., is in negotiations with seven potential investors and steel companies interested in AHMSA.

It stands out that AHMSA recognized that it will be declared bankrupt. The liquidator will be in charge of selling the company and not its current shareholders. Because Argentem Creek Partners' clauses to purchase AHMSA were not met, Ancira remains the largest shareholder.

Read more: SEAISI: Construction recovers in some ASEAN countries, leading to increased longs imports

Vietnam Steel by Hoa Sen Group