The automotive industry and the production of household appliances in the EU have problems with sales of their products

Global hot-rolled steel prices stagnated in most major regions in July. The market is under pressure from a seasonal slowdown in demand and a high supply of products. The US market suffered the most as prices fell by $90 per tonne.

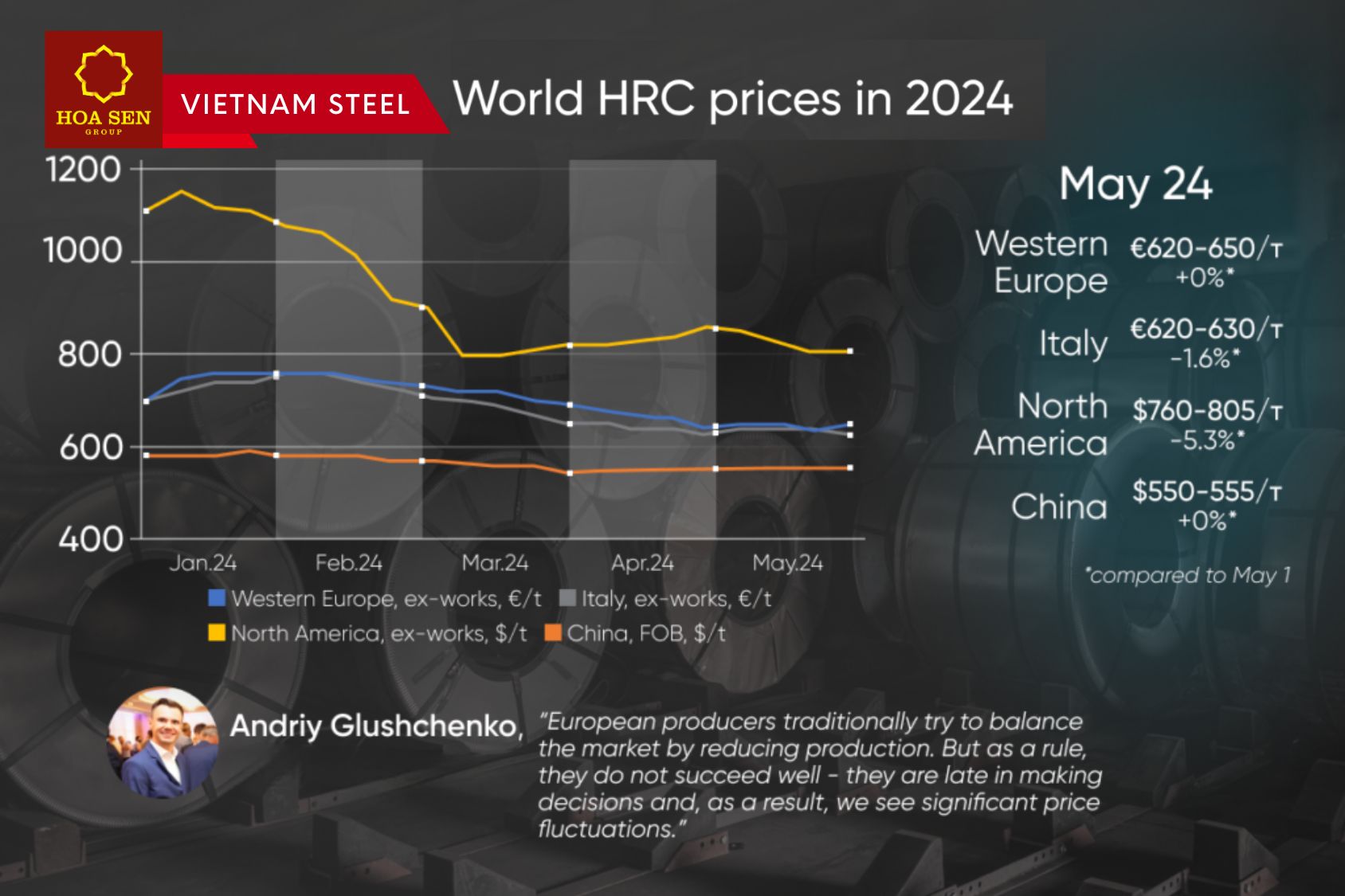

Prices for hot-rolled steel plates in the European market fell slightly in June 2024. In Western Europe, hot rolled coil prices decreased by 1.6%, or €10/t, to €620-630/t Ex-Works between May 31 and June 28. In Italy, the price drop was more significant – by 3.8%, or €25/t, also to €620-630/t Ex-Works. The respective price levels are the lowest since the beginning of the year.

The EU hot-rolled coil market stagnated in June due to weak demand from end users and distributors. The main consumption sectors, such as home appliance producers and the automotive industry, ordered only limited volumes of rolled products. At the same time, prices were expected to rise as imports declined due to the 15% restriction on the tariff quota for «other countries.»

However, over time, the lower availability of imported rolled products will support European producers and market prices. Buyers believe that technical restocking is expected in August, and the quota restrictions may lead to a shortage of hot-rolled steel along with rising prices, both imported and domestic. At the same time, no significant price increase is expected in the second half of the year, as the automotive and household appliances sectors are also facing sales problems.

«We believe that the European market still has the potential to increase prices for hot-rolled coils by €30-40 per ton. On the one hand, business expectations in steel-consuming industries are improving. On the other hand, changes in the quota system are driving up import prices. If these factors are not enough, European plants may resort to a proven practice of cutting production by shutting down facilities for repairs,» said GMK Center analyst Andriy Glushchenko.

At present, steelmakers are agreeing to lower prices as it is more important to maintain sales during the seasonal lull to ensure a certain level of capacity utilization.

In the short term, the market will remain stable with little price fluctuation, although producers are looking for ways to increase prices to improve profitability without losing orders.

In the North American market, prices for hot-rolled plates fell the most in June, by 11.4%, or $90/t, to $700/t Ex-Works. At the same time, the forecast price for July 5 is $660/t, the lowest level since December 2022.

Prices for rolled steel in the United States stagnated during the month, similar to the European market. Product orders declined, and some mills resorted to significant discounts to release inventory. Market participants say prices have now dropped to their lowest operating level, and mills are preparing for a potential decline in utilization.

«Prices continue to fall. Demand is weak and looks set to be worse than usual this season. It is necessary to further reduce capacity utilization to stop the decline. At the same time, integrated steel mills still have room for price cuts, but this will significantly hurt the electric steel mills,» the distributor said.

In China, hot rolled coil prices fell by 2.7%, or $15/t, to $535/t FOB between May 31 and June 28, 2024. The negative dynamics were driven by low consumption both domestically and by export buyers, although the market for metallurgical raw materials was mostly strong. Production was stable, and the release of inventories slowed.

Read more: High costs for electricity in the EU will remain in the transition to net zero

Vietnam Steel by Hoa Sen Group